In working with our financial adviser to roll over some retirement funds from previous employers, my husband and I began discussing different things that we could do to be able to put more money aside for retirement. There are several areas in which we (and maybe you!) could easily adjust our spending to free up some money for retirement and other goals. I’ll lay out a few habits that might need adjusting and not only show you where to look for “extra” money, but also how investing that money now can help you in the long run!

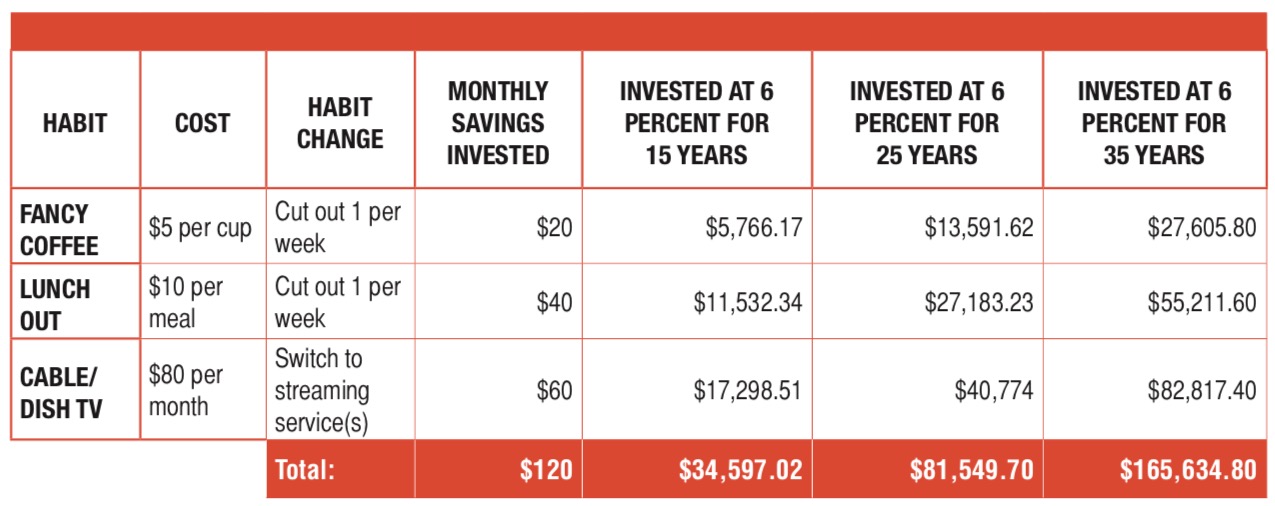

The example below looks at three habits (fancy coffee, eating out for lunch and cable/dish TV)

and shows how you can change what you do in these areas and what the impact could be on your retirement investments. In this example, we are looking at habit changes resulting in a total of $120 invested per month over the course of 15, 25 and 35 years, respectively. We are assuming an average of 6 % return on investment. (Note: This is an average return on investment over an extended amount of time, which is very different from what you would earn if you just left this money sitting in a savings account at a tiny interest rate.)

How about that? Note that the amount you end up with (for example, a total of $81,549.70 at the end of 25 years) is a whole lot more than the amount you actually invested (in this instance $120 per month x 12 months x 25 years = $36,000). The remaining amount ($45,549.70) is what that money earned you over time! For me, it is totally worth changing a few habits to have a huge impact on my financial future!

ADVICE FROM AN EXPERT

Marc Stalvey, a financial adviser with Edwards Jones, shared with me several areas in which investors tend to make mistakes throughout their various life stages.

Young investors who may be just starting out in the workforce may form the bad habit of investing too conservatively or just not investing at all. Time is your most valuable asset when planning for retirement, so not investing while you are young can be greatly detrimental to your future plans.

Mid-career investors may be in a place where they have advanced in their careers and are earning a higher salary. Their biggest mistake is not putting a high enough percentage of their income toward retirement. As your income increases, your retirement investing should follow suit.

Near-retirement investors are coming to the end of their time in the work force and coming to a place where they will soon begin withdrawing from their investment funds. The biggest mistake they make is investing too aggressively. At this point, they may need to shift their focus to more fixed income vehicles.

When asked about the biggest mistake he sees across the board regarding retirement planning, Stalvey said that avoidance and aversion are the main culprits. People tend to just ignore their retirement planning all together and think they will be able to depend on Social Security or their ability to just keep on working. This results in a huge number of people being ill prepared and underfunded for retirement.

*Marc Stalvey is a financial adviser with Edward Jones in Ocala, Florida and has 10 years experience in financial services.